Finance

Double Entry accounting is a fundamental accounting method that records financial transactions by entering them into two separate accounts: a debit and a credit. Each transaction affects both sides of the accounting equation, ensuring that assets equal liabilities plus equity. This system helps maintain the accuracy and integrity of financial records, enabling businesses to track their financial health and comply with accounting standards.

Dual Accounting Principle

Double Entry Accounting is crucial for maintaining accurate and balanced financial records, providing a complete picture of a company financial activities.

Maintain Balance And Accuracy in Accounting

.

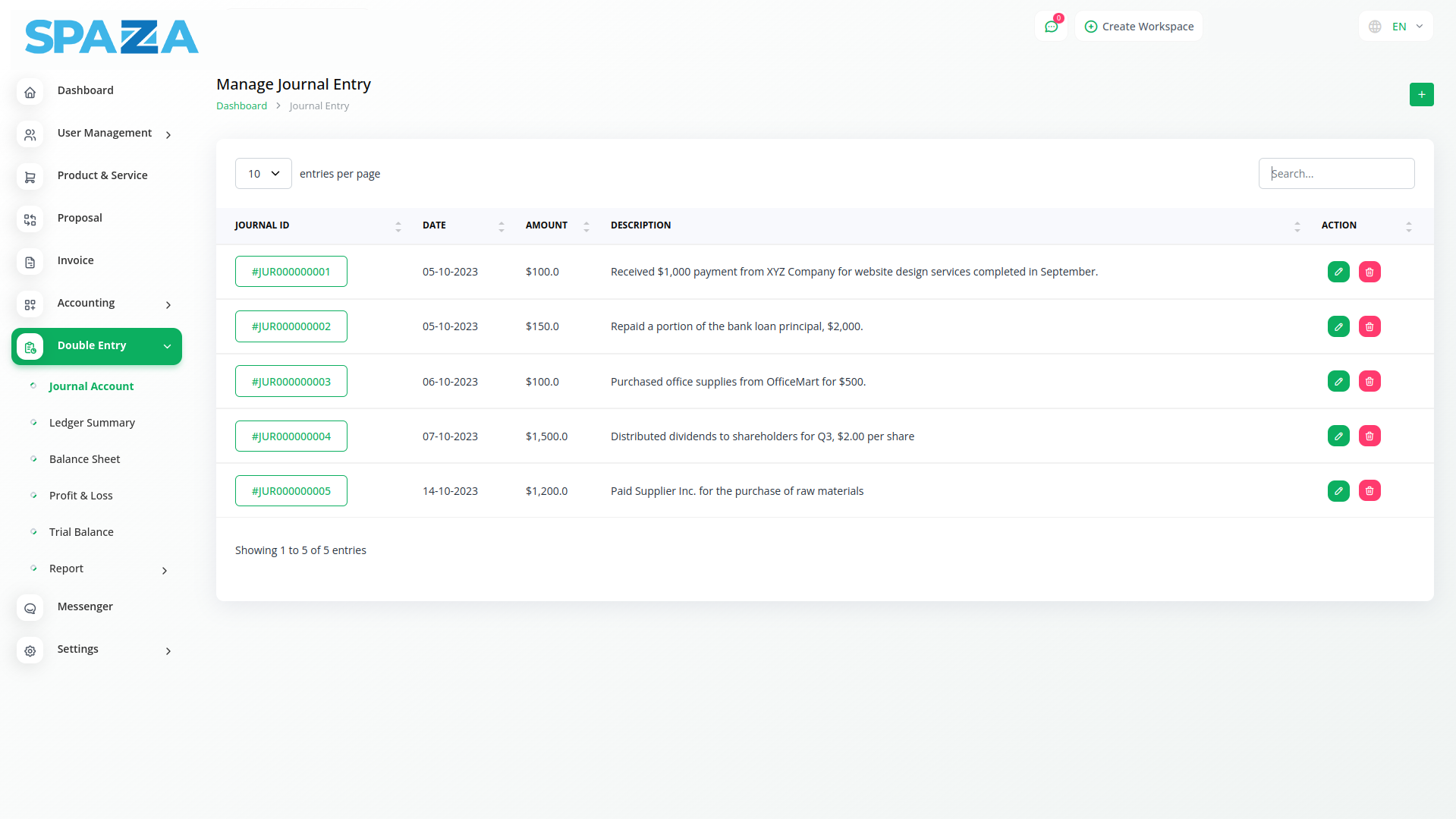

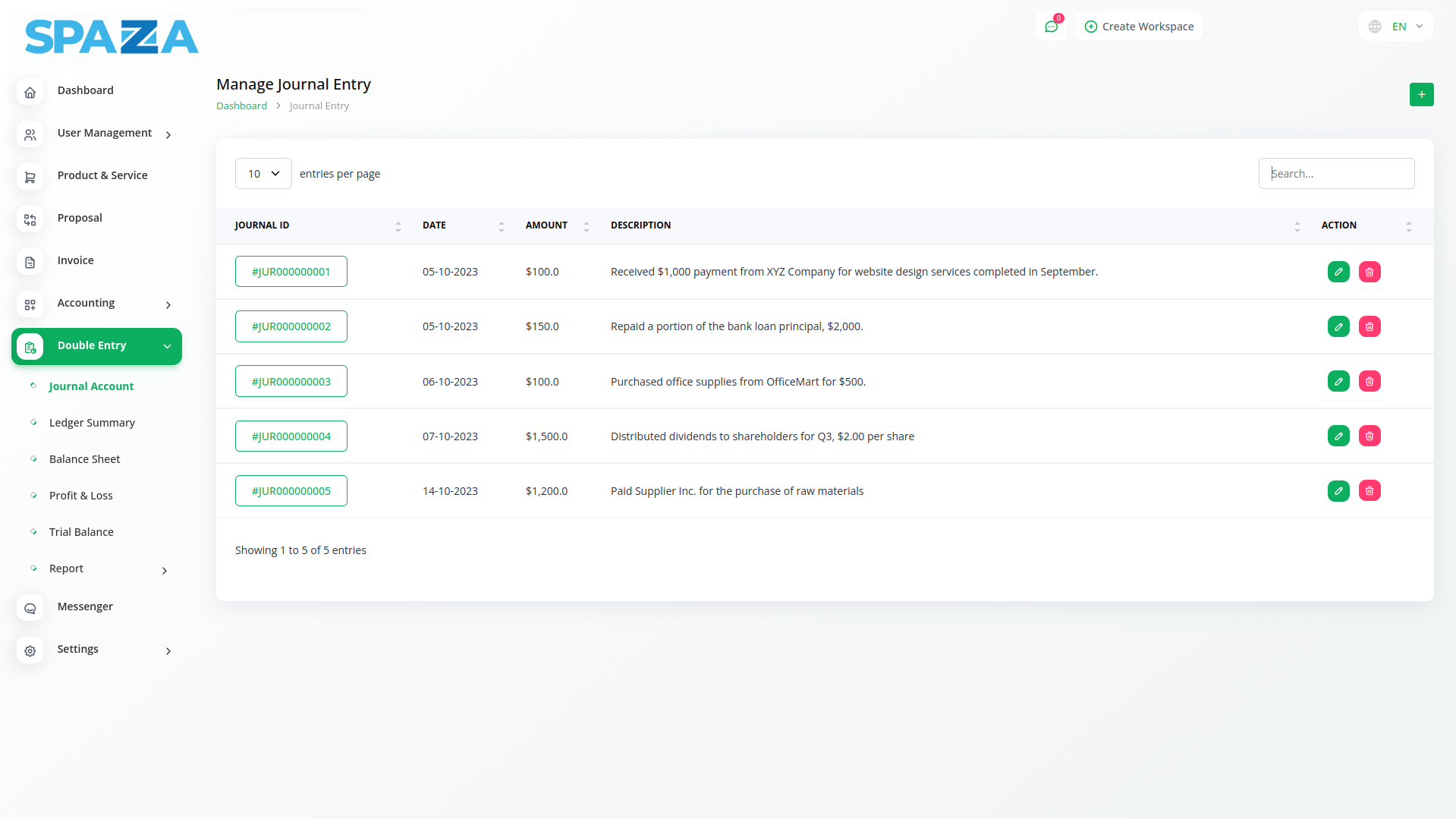

Journal Account typically refers to an account used in the double entry accounting system to record individual financial transactions. In the double entry system, each financial transaction is recorded in a journal account with both a debit and a credit entry to ensure the accounting equation (assets = liabilities + equity) remains balanced.

To perform accounting journal entries, identify the transaction, analyze its impact on accounts, and record it in a journal with debits and credits. Ensure entries balance and post them to the general ledger for accurate financial reporting.

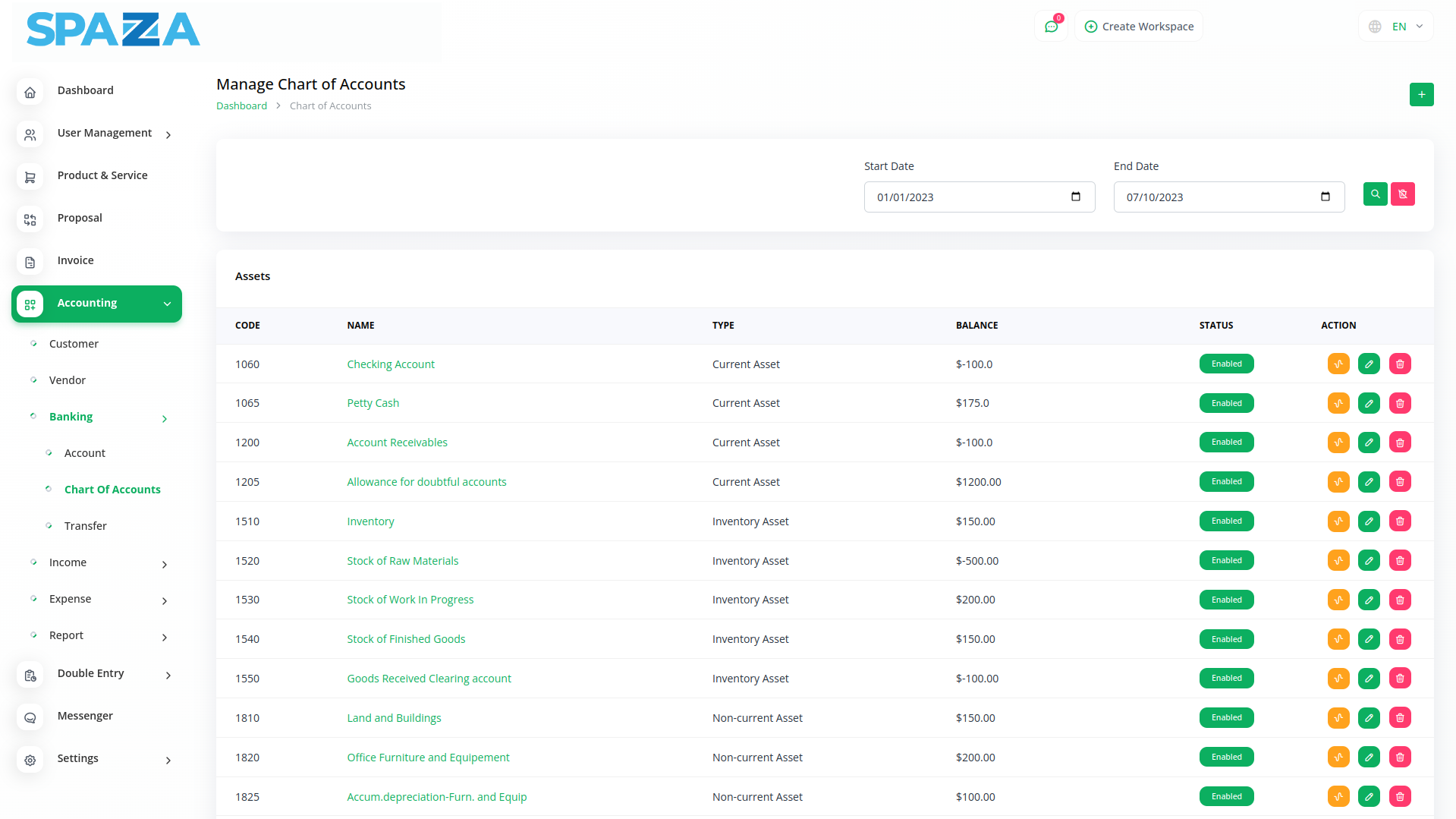

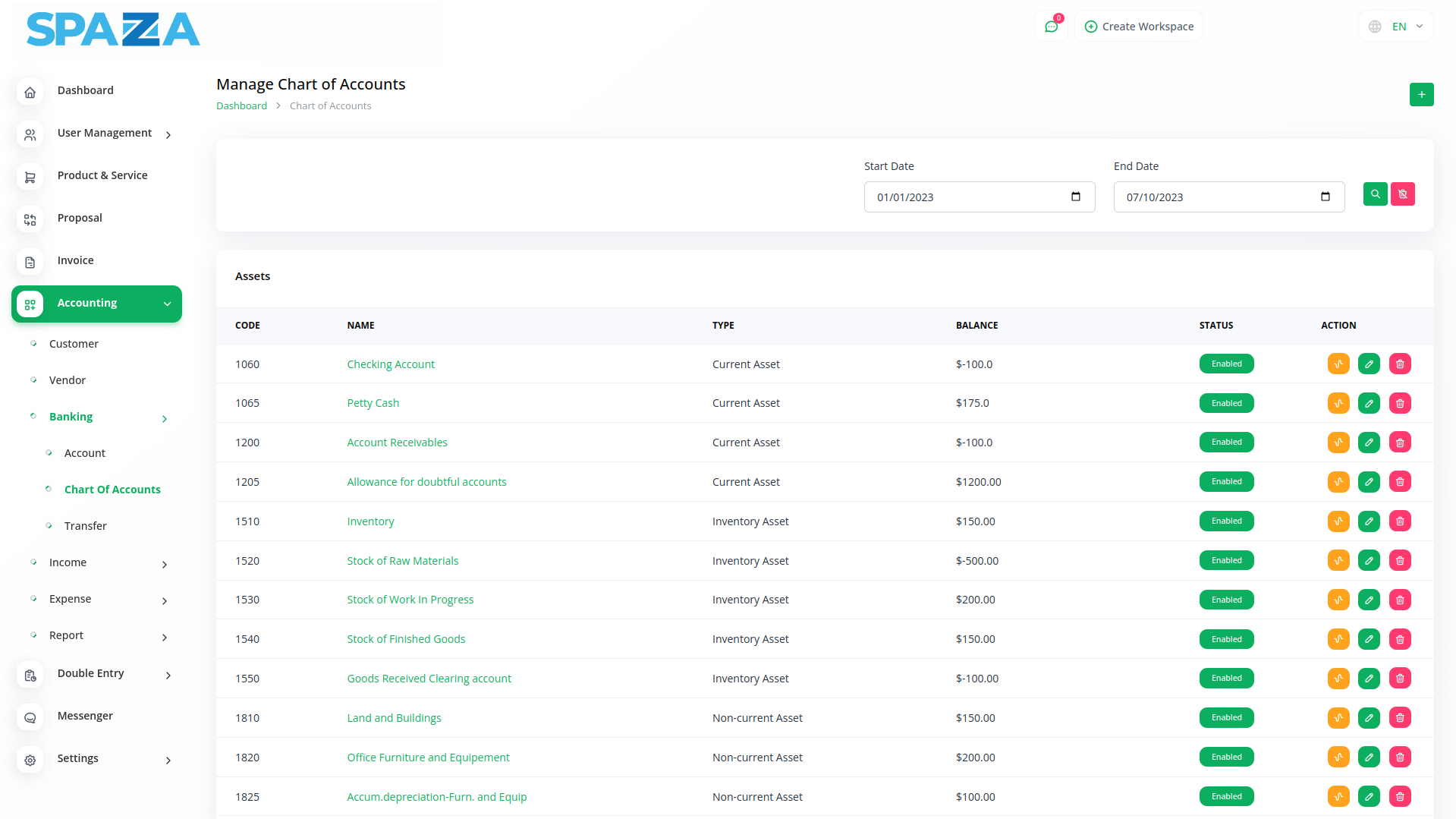

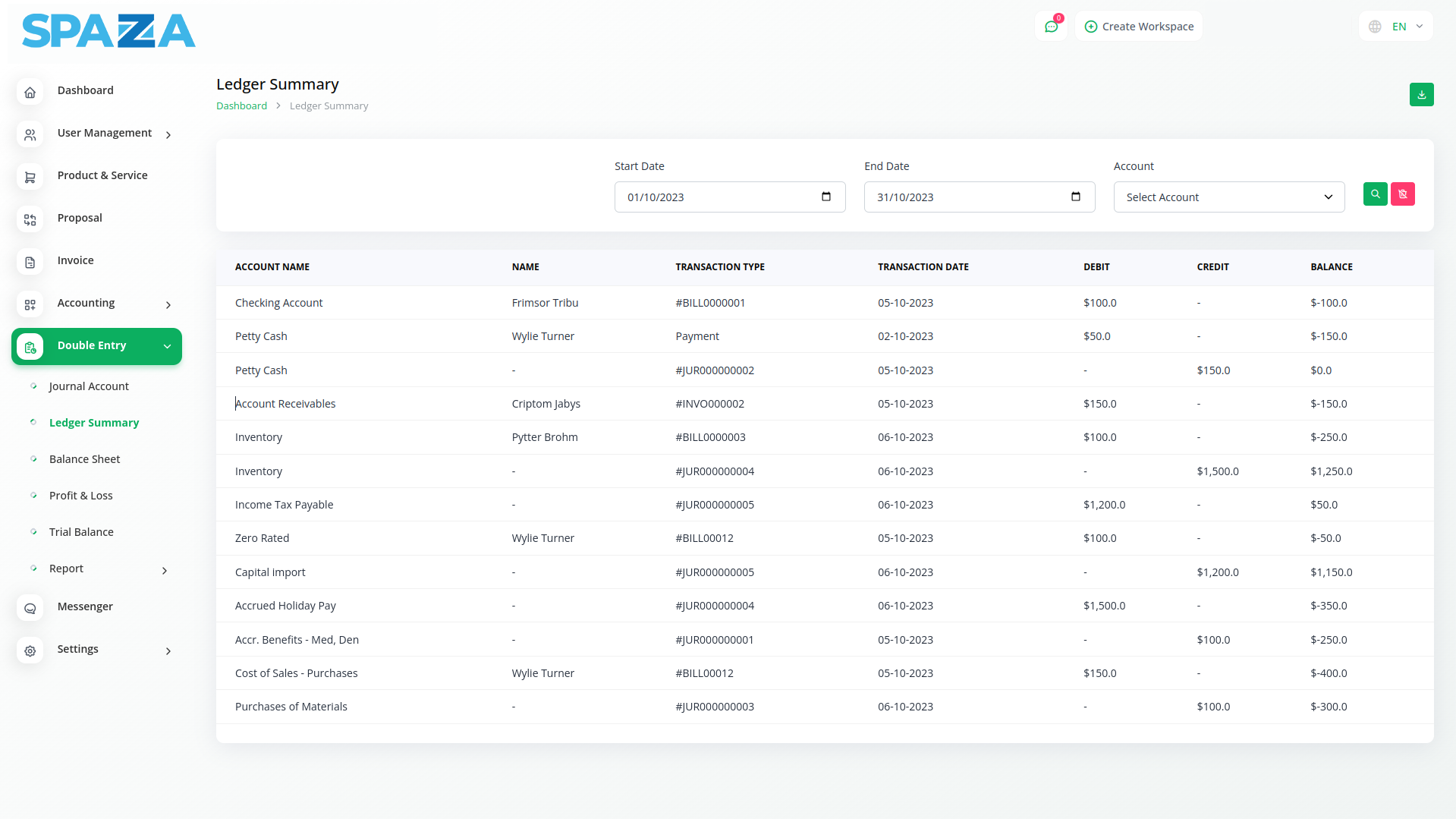

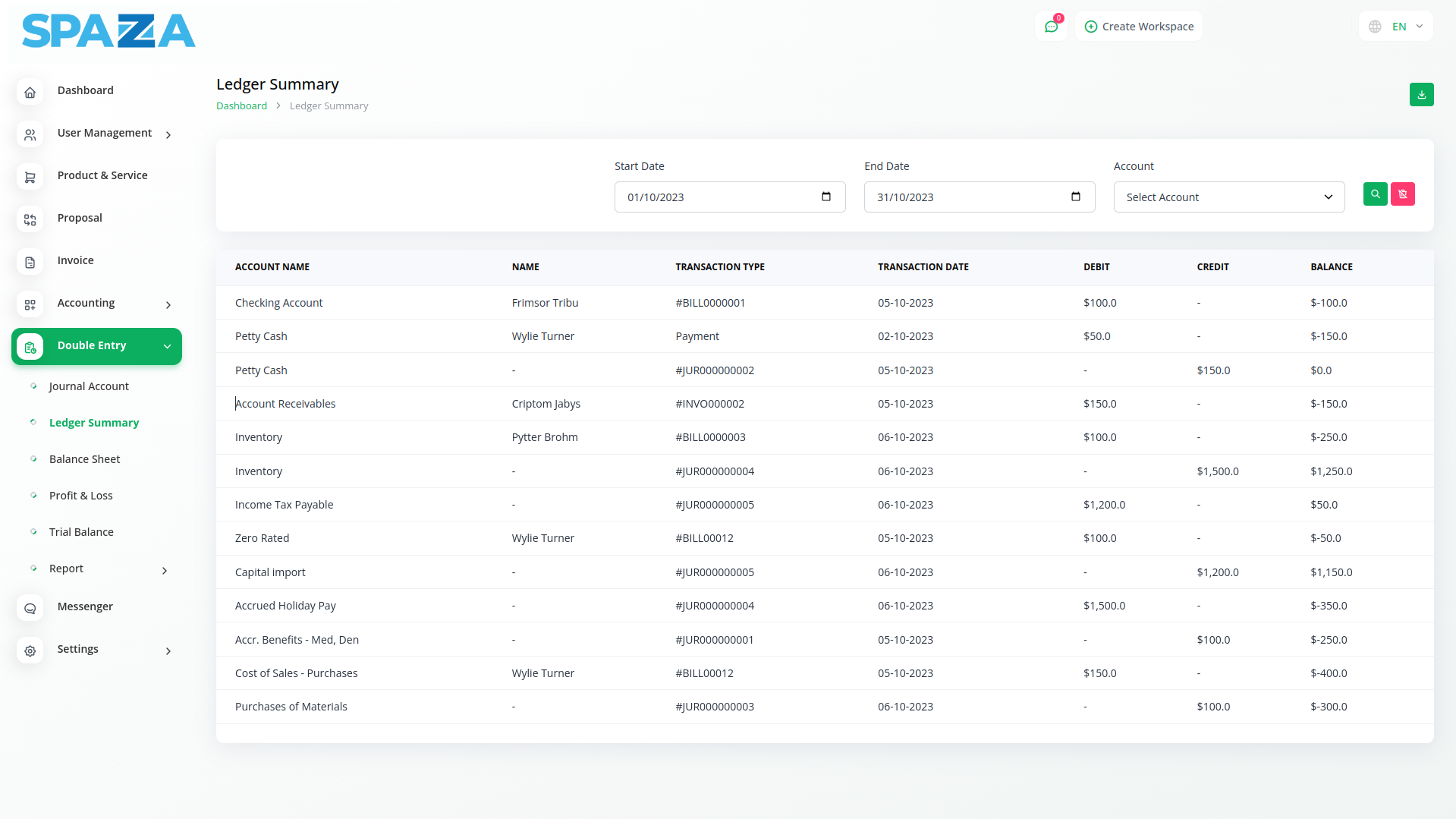

Tools for keeping an accurate general ledger

A ledger account is a record of all transactions affecting a particular account within the general ledger. Individual transactions are identified within the ledger account with a date, transaction number, and description to make it easier for business owners and accountants to research the reason for the transaction.

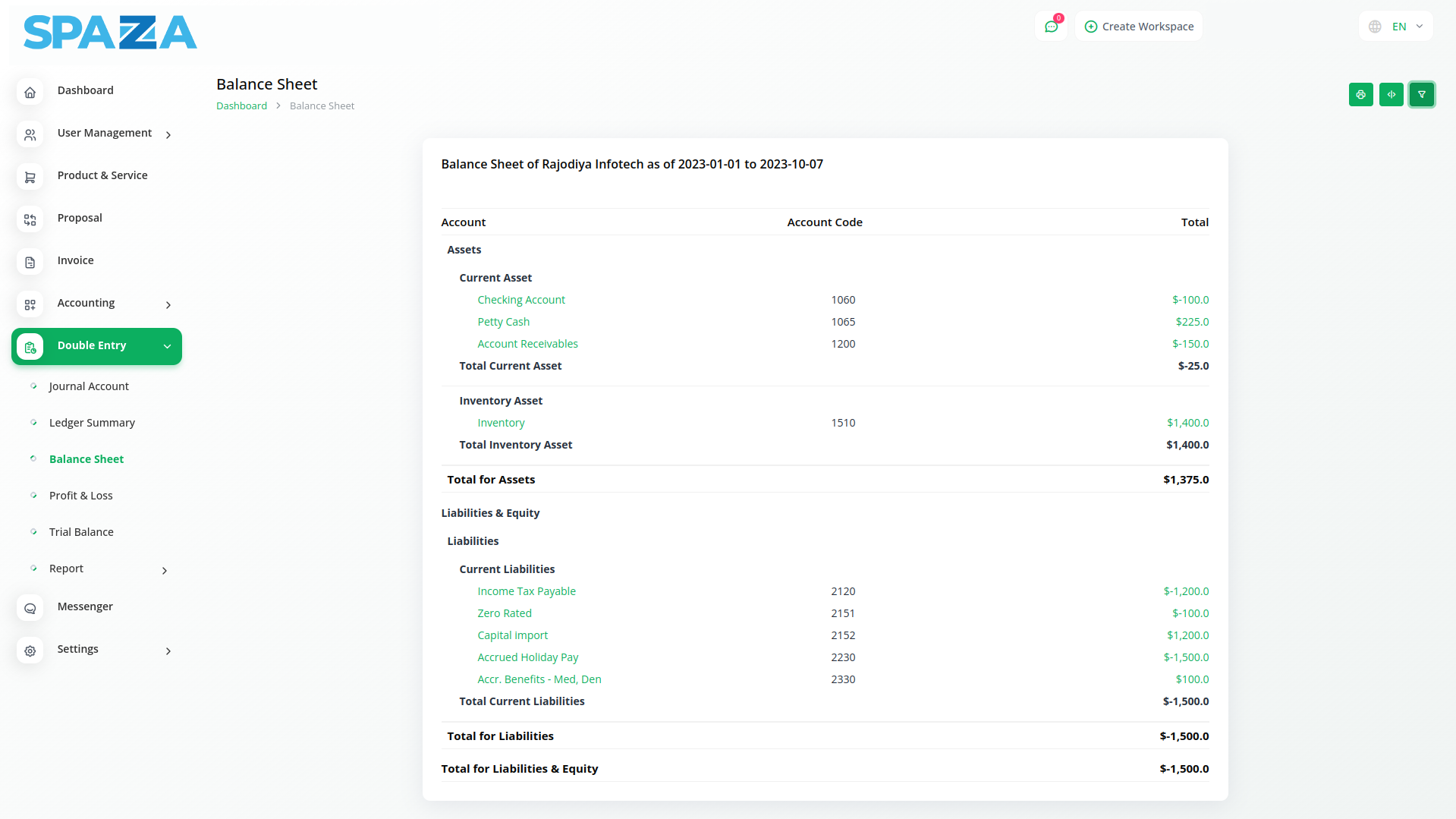

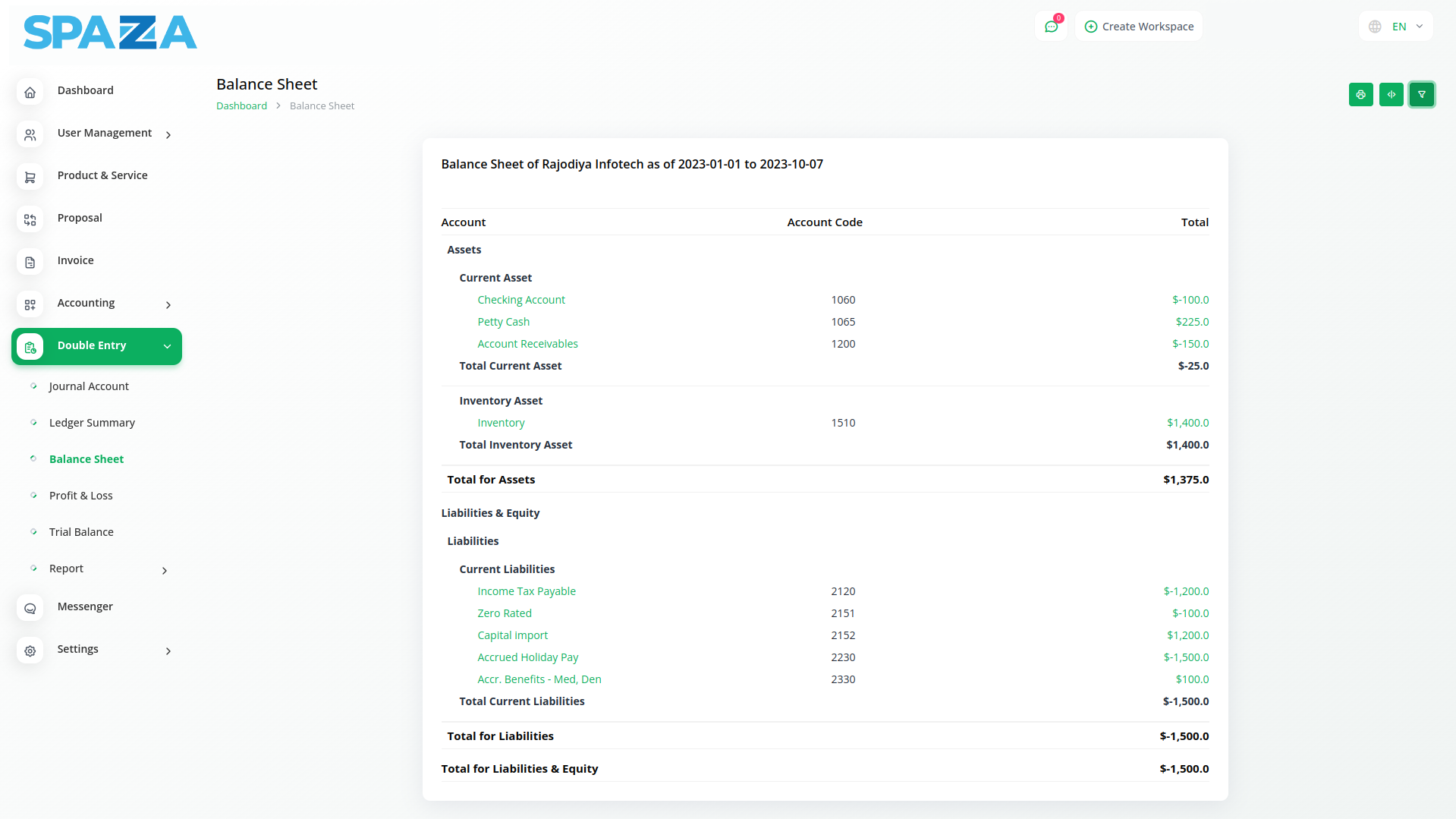

Balance Sheet

Balance sheets provide a snapshot of a company financial position by presenting its assets, liabilities, and equity at a specific point in time. Assets are what the company owns, liabilities are what it owes, and equity represents ownership. The equation, Assets = Liabilities + Equity, ensures the balance sheet fundamental principle: assets must equal the sum of liabilities and equity.

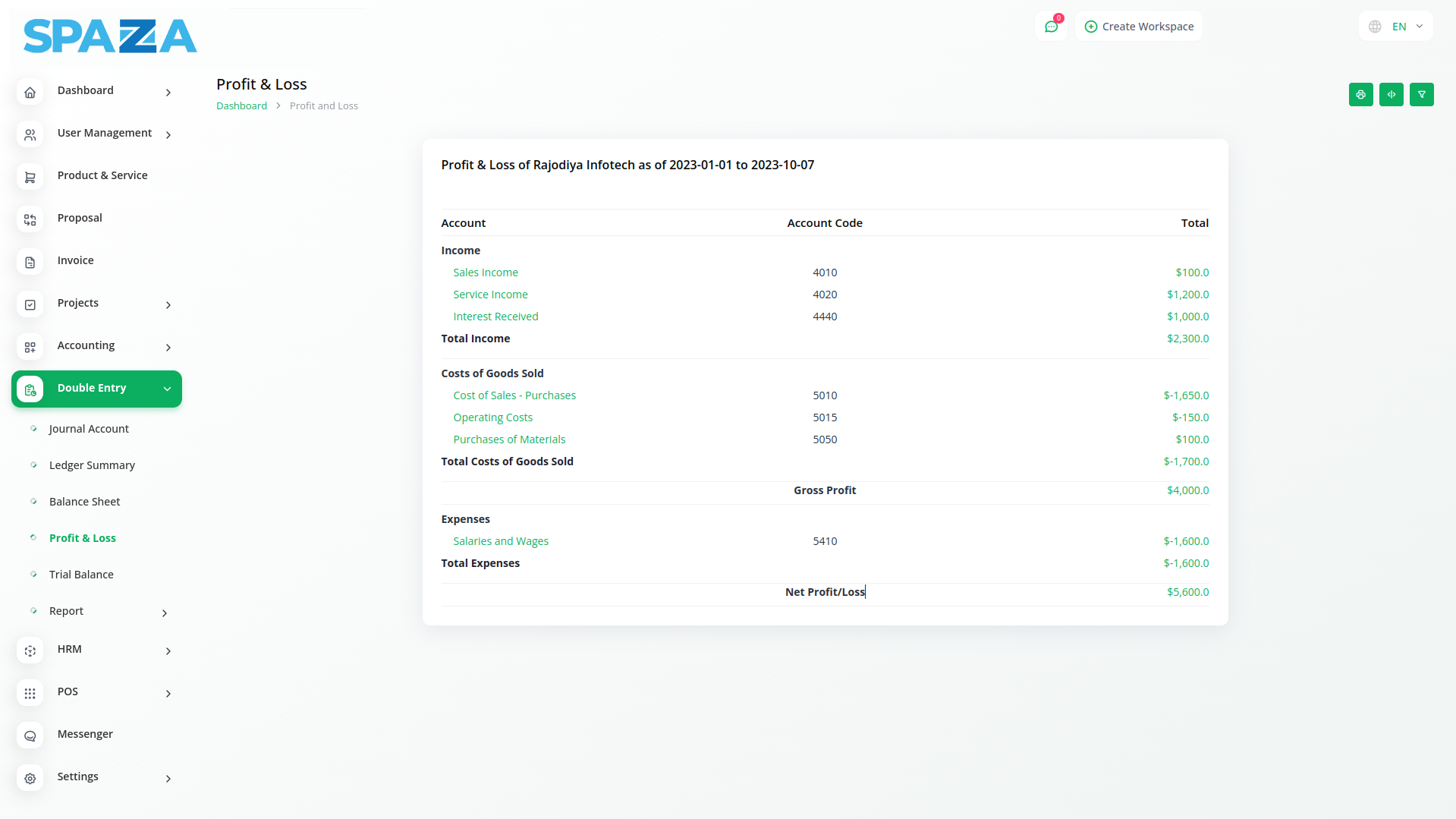

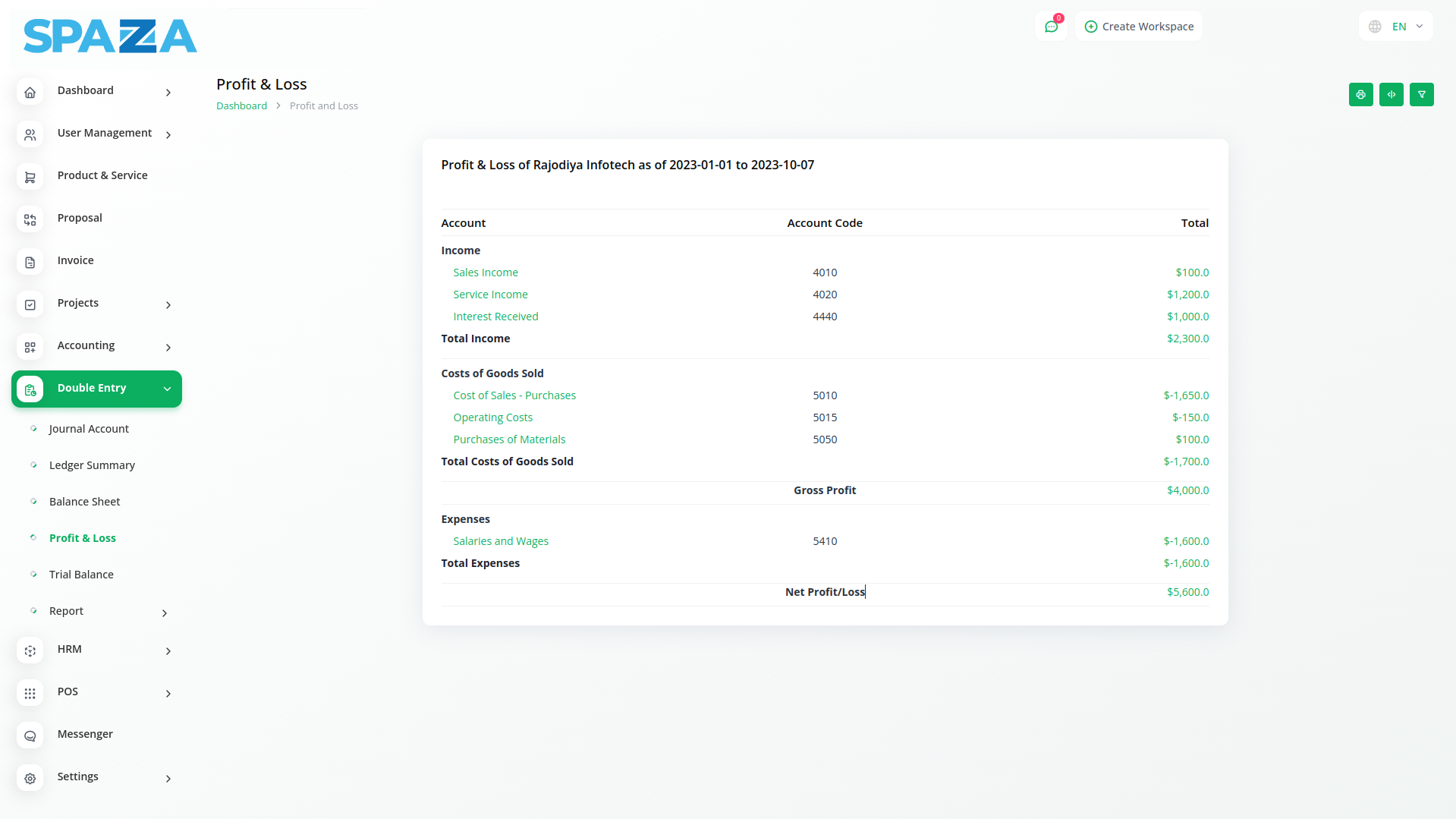

Profit and Loss (P&L) Statement

Profit and Loss (P&L) statements, also known as income statements, provide a detailed financial overview of a company performance over a specific period. They start with total revenues generated from sales and then subtract all operating expenses, including cost of goods sold (COGS), operating expenses, taxes, and interest. The resulting net profit (or loss) represents the company bottom-line earnings after all costs are considered.

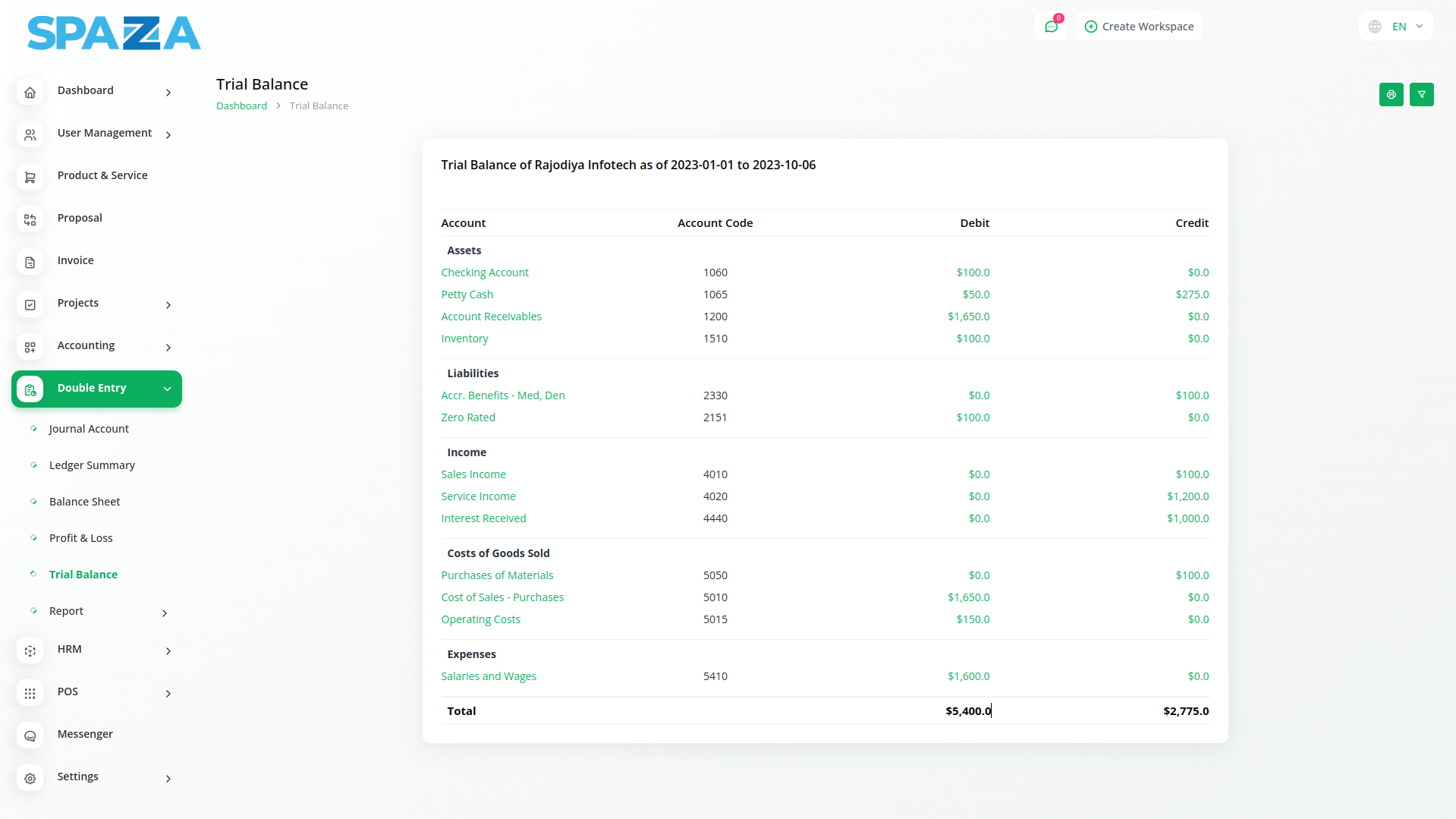

Trial Balance

A Trial Balance is an accounting worksheet that lists all general ledger accounts and their balances. It serves as a fundamental check to ensure total debits equal total credits, verifying data accuracy across major accounting items like assets, liabilities, equity, revenues, expenses, gains, and losses.

Why choose dedicated modules for Your Business?

With Spaza, you can conveniently manage all your business functions from a single location.

Empower Your Workforce with SPAZA

Access over Premium Add-ons for Accounting, HR, Payments, Leads, Communication, Management, and more, all in one place!

- Pay-as-you-go

- AI Enabled

- Secure cloud storage

Why choose dedicated modules for Your Business?

With Spaza, you can:

1. conveniently choose what functions you need

2. only pay for what you use

3. manage all your business functions from a single location.